Our philosophy and origin of the name "Labyrinth"

Labyrinth HF is supposed to find the solution...

...for every complex jigsaws and puzzles occuring in the form of sophisticated labyrinth of unknown strategies or unidentified algorithm, which show the way in a jungle of paths of complicated world of financial markets no matter which assets or investment strategies do we focus on. Labyrinth HF refers to a jigsaw, a complicated problem, inextricable from the investor’s point of view.

Labyrinth HF comes exactly at this place with its expertise, know-how, long-term experience and specified vision which will help the investors to go through this labyrinth of upredicted events and frequent turmoils. At the same time LHF to choose only the path with lowest uncertainty (representing the volatility of returns) of ultimate success.

How we generate profits?

Algorithmic strategies

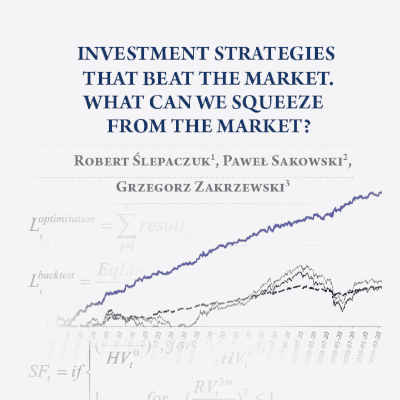

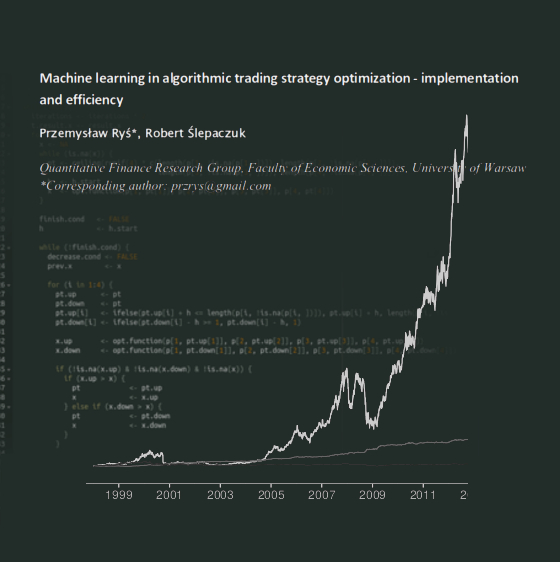

Our solutions are fully automated, ML & AI based investment systems consisting of several strategies each. Strict regime of development process accompanied by extensive technical expertise and financial knowledge lead us to achieve outstanding performance results.Diversification

Multi-layer diversification approach allows for smart risk-reward optimisation solutions. Risk based asset allocation engine fully integrated with algorithmic systems continuously manages performance, risk limits and deliver advanced management dashboards.Advanced Testing

Innovative, internally developed holistic approach for strategy testing ensures all the systems are exposed to rigorous assessment processes. Most recent statistical knowledge supported by ML and AI advances are the key elements of the process.Risk Management

Rigorous risk management is in the center of our activities through the whole cycle: from the concept till deployment of strategies and portfolio oversight. Risk centric approach allows us to achieve ultimate goal.Experience and knowledge

Excellent mixture: top university scientists with strong business management experience mixed with the smartest mathematicians, physicist and quantum chemistry experts. Continuous development allows us to navigate smoothly among most advanced data science technologies creating new investment industry standards.Completely automated trading

Our innovative, fully automated trading systems separates emotions from science and business, saves time and costs, integrates huge amount of information, performs sophisticated transformation and analysis within milliseconds in order to execute transactions. Our OMS is integrated with the most reputable and cost efficient US brokers.Data Analytics

Strong research team and employed technological advances continuously search huge amount of data for new opportunities. The newest technologies are backed by strong financial and market experience.Exchanges

Financial Instruments

Algorithmic Strategies

30 000+

Lines of code

We create new algorithmic trading quality

"No matter how much experience you have, there’s always something new you can learn and room for improvement."

Roy T. Bennett

Systematic Options Investment Strategies Trading Engine

Automatic Futures Trading System

ML tools for strategies optimization

AI Risk Management System

We are focused on

Data collection and management

Cloud based solution and most advanced technologies employed. Rigorous data quality management.

Quantitative Research

Strong data science team supported by highly experienced academics and practitioners.

Trading

activity

Fully automated trading engine able to continuously trade on futures and options. OMS integrated with well-established brokers. Integration with advanced risk management system.

Strategy design and backtesting

Rigorous procedure, internally developed and statistically proven approach. Own IT solutions precisely replicating live trading environment.

Portfolio oversight and management

State of the art risk management approach. Risk optimisation and asset allocation engine.

Meet Our Team

20 years of experience in algorithmic trading, being formerly investment director of quantitative fund management division at Union Investment TFI. Expert in practical implementation of financial theories and models in asset management. Licensed Securities Broker (#2245) and Investment Advisor(#316).

15 years of experience in market data analysis focused on financial econometrics and machine learning solutions for high-frequency data. Experience in numerous commercial and academic research projects.

15 years of experience in banking industry. Managing risk of portfolios reaching $20 bn exposure. Previously focused on application of quantitative models in credit risk. Worked for Citibank, Deutsche Bank and BNP Paribas Group.

Has background in Theoretical Chemical Physics and Quantum Dynamics. An experienced C++ developer and enthusiast of modern programming & product engineering. Currently preparing PhD in Quantitative Finance.

Has a strong background in mathematics and quantitative methods. Experienced in the automatic trading strategies design and implementation, as well as in the applying advanced mathematical methods for financial purposes.

Details

Benjamin Graham

Investor's problem

Investors worldwide seek to achieve

stable absolute returns

uncorrelated with equity market moves

and overall business cycle...

Our Solution

We focus on delivering complete

investment solution for institutions and

individuals who are interested in

highly diversified portfolio...

Advantages

Miscellaneous sources of revenues

coming from diversified

structure of assets

under management and...